Champion Iron Capitalizes on Demand for High Grade Iron-Ore

There’s a sweeping change coming to the global steel industry. As countries around the world enact legislation to help the planet stave off the effect …

There’s a sweeping change coming to the global steel industry. As countries around the world enact legislation to help the planet stave off the effects of climate change, the steel industry is expected to follow suit. The steel industry represents approximately 8% of global greenhouse gas emissions, leading to great pressure for global steelmakers to decarbonize their operations. As such, the expected shift in the steel industry is set to trigger a growing appetite for high-grade iron ore products, which lessen emissions by reducing the use of coal in the steel making process. In addition to optimizing blast furnaces to reduce emissions, it is anticipated that the steel industry will redirect much of its steelmaking capacity to an alternative steelmaking method, which utilizes electric arcs that do not depend on coal as an energy source, and primarily consumes scrap steel as an input. While this transition appears elegant to reduce the steel industry’s emissions, quality scrap availability is already limited, leading electric arcs to depend on ultra-high purity iron ore material in the form of Direct Reduced Iron (“DRI”) as an alternative input.

This expected shift in the steel industry is particularly beneficial to the few companies that produce exclusively high-grade materials that qualify as DRI feed, like Canadian based iron ore producer and development company Champion Iron Limited (“Champion” or the “Company”) (TSX: CIA, ASX: CIA, OTCQX: CIAFF).

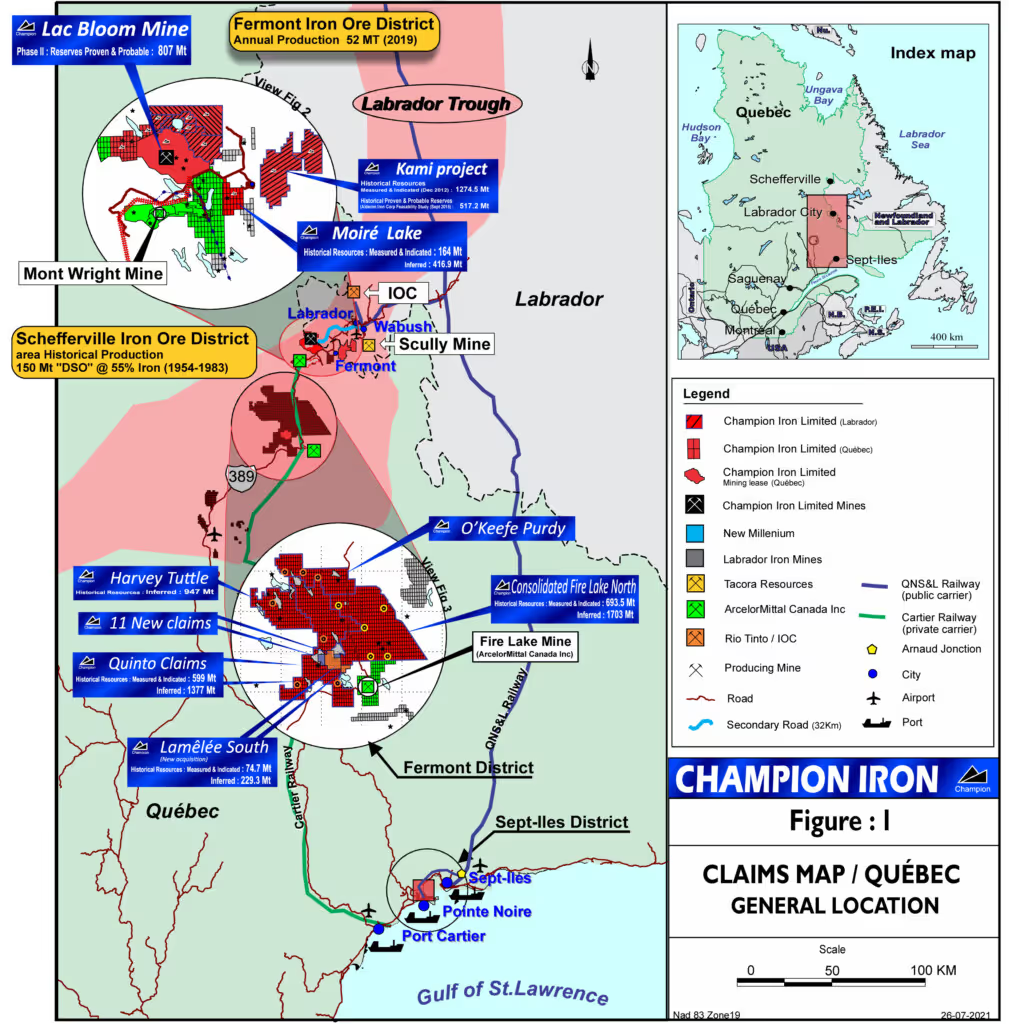

Champion’s flagship project is the Bloom Lake mine (“Bloom Lake”), located in the Labrador Trough area in north-eastern Québec. The Company’s current output is around 8.0 million tonnes per year of high-grade iron ore concentrate with a Ferrous content of 66.2%, and a proven ability to produce an iron ore concentrate which qualifies as direct reduction feed and can ultimately be consumed by electric arcs as a substitute for scrap steel. The Company is also set to double its output by mid-2022 thanks to the Bloom Lake Phase II expansion project (“Phase II”), a colossal undertaking which began nearly ten years ago with the mine’s previous owner. With the completion of Phase II, Bloom Lake will have received cumulative investments by the asset’s prior owners and Champion exceeding US$4 billion, nearly double Champion’s current market valuation. Driven by robust profitability, the Company’s balance sheet is already in a net cash position as of the third quarter of its 2022 fiscal year. Champion has a bright future to benefit from an estimated 20 years of mine life in addition to prospects for decades of available resources in the district. With a proven operational track record since the recommissioning of Bloom Lake in 2018, the Phase II project nearing completion expected by April and a robust balance sheet, Champion announced on January 26, 2022, an inaugural dividend of C$0.10 per ordinary shares. In tandem with the announcement, the Company detailed that its board of directors will also evaluate the prospect for future dividends concurrently with the release of its semi-annual and annual results.

Champion Iron’s CEO David Cataford sees two main reasons for the recent spike in interest – and prices – for high-grade iron ore, and why Champion stands to benefit. “Iron ore prices and premiums for high-grade iron ore products recently reached multi-year highs. Governments globally are trying to stimulate their economies, creating demand for steel in infrastructure projects, and the other factor relates to the steel industry adapting to the massive push to decarbonize the planet. The steel industry is experiencing a structural shift and our products serve as a global solution to reduce emissions…Our vision to capitalize on the rising demand of high-grade iron ore products is paying off.”

The Labrador Trough area has been an established iron ore precinct for decades and is recognized as Canada’s largest iron producing region. Bloom Lake benefits from the region’s abundant infrastructure – including ready access to the newly built deep-water seaport in Sept-Îles – and favourable relations with the mining-friendly Québec provincial government.

Champion acquired Bloom Lake and related assets in April 2016 for $10.5 million, and quickly pumped in another C$200 million dollars towards structural changes and upgrades at the site. These investments were key to reducing the project’s operating costs by nearly 50% and reduced emissions by 40%, enabling Champion to become both one of the lowest emission intensity operators and one of the lowest cost iron ore operators among global high-grade producers. The combination of market leading high-purity iron ore products, available infrastructure and access to renewable power provides a triple value proposition according to CEO David Cataford. “In addition to our superior products, we are also fortunate to benefit from renewable hydroelectric power in Québec, positioning our Company globally to offer one of the leading solutions to reduce emissions across the steel supply chain.”

Thanks to the rising global interest in high-grade iron ore products, Champion is expanding their footprint in the Labrador Trough. The company announced two recent acquisitions in the area: The large-scale Kami Project, which sits directly adjacent to Bloom Lake, and could benefit from its existing infrastructure; and the Lac Lamêlée Project, about 40km to the south, in a much larger hub of iron resources already owned by Champion, cumulating to historical resources nearly ten times the scale of Bloom Lake. The new acquisitions, together with the company’s existing portfolio, combine to create one of the largest global hubs capable of producing high-purity iron ore products offering Champion organic growth opportunities for decades. The Company is also currently advancing two economic studies, expected to be completed and released in 2022, including an economic study updating the potential of the Kami project, together with a study to investigate the feasibility to bonify its product offering to 69% Ferrous content, which would enable the Company to further reduce emissions in the steel making process and service the electric arc market.

Champion Iron is located between a couple of heavy hitters that have operated in the Labrador Trough region since the 1950s and 60s: ArcelorMittal (NYSE: MT), one of the largest steelmakers in the world, and Rio Tinto (ASX: RIO), one of the largest mining companies in the world. According to Champion CEO, Mr. Cataford, Champion makes for an attractive opportunity for eco-minded investors. “If you believe in the world’s desire to decarbonize, and if you share our vision of high-grade iron ore as a solution for the steel industry, we believe Champion offers a unique investment opportunity. While some other iron ore miners may have a portion of their portfolio producing high-grade products, Champion stands out as a pure play producer of high-purity iron ore with a massive portfolio of projects in a safe jurisdiction with access to renewable power.”

In a rapidly transitioning steel industry, nimble operators like Champion have positioned themselves ideally. With an in-demand, high-purity products that helps reduce emissions in the steel-making process, and an expanded property portfolio helping them size-up to a global scale opportunity, the company appears to be ticking all of the boxes for success and growth.

As CEO David Cataford sums up, “We have the right products, right people and right partners! Our vision of the rising demand for high purity iron ore products, our operational expertise and our local support, enables us to capitalize on a structural shift in the steel industry.”

For more information on Champion Iron (TSX: CIA, OTCQX: CIAFF) please click the request investor info button.

FULL DISCLOSURE: Champion Iron is a client of BTV-Business Television. This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. Any action taken as a result of reading information here is the reader’s sole responsibility.

Latest Posts

Hot Companies

You might also like