TD Q U.S. Small-Mid-Cap Equity ETF Offers an Investment Opportunity Not Seen in a Long Time

“Right now is a good time to invest in the U.S. small and mid-cap space,” declared Julien Palardy, Managing Director, Head of Quantitative Equity at TD Asset Management (TDAM).

“Right now is a good time to invest in the U.S. small and mid-cap space,” declared Julien Palardy, Managing Director, Head of Quantitative Equity at TD Asset Management (TDAM). “So, if you're looking to invest long-term, say over the next 5 to 10 years, then this is a very good entry point.”

It’s true. Historically, U.S. small and mid-cap stocks have traded at a premium versus large-cap stocks, reflecting their higher growth potential. But today that scenario has changed. The large-cap index has become more expensive, and after earnings bottomed out last year for small and mid-cap companies, they are now trading at a discount, a phenomenon we haven't seen in a very long time.

One way to cash in on this opportunity is through the TD Q U.S. Small-Mid-Cap Equity ETF (TQSM), a fund that uses a quantitative approach to stock selection from the small and mid-cap universe.

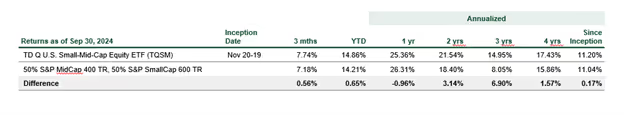

TQSM focuses on profitable companies with conservative leverage and low-price volatility, covering every major sector from consumer staples and discretionary, to industrials and technology, to provide exposure to a highly diversified portfolio of growth-oriented companies. So far, it’s an approach that has worked, as the fund has outperformed its benchmark since its inception over four years ago[i].

Despite being more volatile on a stock-by-stock basis, a diversified portfolio of small and mid-cap stocks can lead to lower risk and higher returns. History bears this out. While large caps are by nature mature companies, small and mid-caps have room to grow and are often able to be more innovative and agile than bigger entities. This has led to stronger long-term earnings growth for the S&P 400 (mid-cap) and 600 (small-cap) Indices in the range of 2% to 3% annually over the last 10 years[ii].

The indices used as underlying investments in ETFs like TQSM can themselves affect performance. For instance, in the highly concentrated S&P 500 Index, there are five companies that account for more than 35% of the overall risk, with tech giant Nvidia driving more than 20% of the risk of the index on its own, according to TDAM's risk estimates. While an outperformance of large established stocks can lead to strong index returns, index performance can also suffer when one or two key companies underperform. Contrast that to the S&P 1000 Index (the S&P 400 and S&P 600 combined), where the top five companies account for roughly 4% of the overall risk, which leads to a more evenly and broadly distributed contribution of single stocks to the performance of the index.

TQSM benefits from the more diversified approach that investing in the S&P 400 and S&P 600 allows, as the fund holds roughly 170 to 180 stocks with no single position above 3% of the portfolio.

Investing in small and mid-caps is probably one of the most challenging things to do in the capital market space, and covering the entire S&P 1000 universe of stocks on its own can be a mammoth undertaking. Fortunately, TDAM’s quantitative investing approach takes the difficulty and guesswork out of the equation.

Quantitative investing relies on a data-driven approach to make investment decisions. It’s a process that employs mathematical models, algorithms, and statistical analysis in the portfolio construction process.

“Quantitative investing is really useful when investing in small and mid-caps, because it allows you to process a lot of data,” Palardy said. “In the case of the S&P 1000, it enables us to look at more than 500 individual factors for every one of the roughly 1000 stocks in the index. That’s over half a million data points that we process every day just for this specific investment universe. Given the volatility of small and mid-caps, they really need to be assessed objectively.”

TDAM’s quantitative approach to small and mid-cap investing is difficult to beat. With over 25 years of experience, its quantitative investment team is virtually unmatched in Canada. It consists of 30 dedicated managers, data specialists, and researchers, who together manage over C$125 billion in assets under management.

All told, they are part of an ongoing active management strategy that rebalances the fund on at least a monthly basis for a management fee of 40 basis points - extremely low given the advanced quantitative approach they employ.

“I think this is literally one of the better funds we have in terms of pricing, the nature of the strategy, and the research that we put into it,” said Palardy.

TQSM is also a timely solution. While the continued concentration of the U.S. mega-cap space may be cause for concern, the fund offers a more diversified approach, providing investors an alternative way to access the strongest economy in the world. With the potential for lower risk and higher returns, you have a fund that investors could consider if they are looking to add U.S. equities to their portfolio.

If you would like to learn more about TD Q U.S. Small-Mid-Cap Equity ETF or the full range of ETFs available through TDAM, visit the TD ETF Resource Centre.

Commissions, management fees and expenses all may be associated with investments in exchange - traded funds (ETFs). Please read the prospectus and summary document(s) before investing. ETFs are not guaranteed, their values change frequently and past performance may not be repeated. ETF units are bought and sold at market price on a stock exchange and brokerage commissions will reduce returns.

TD ETFs are managed by TD Asset Management Inc., a wholly-owned subsidiary of The Toronto-Dominion Bank.

®The TD logo and other TD trademarks are the property of The Toronto-Dominion Bank or its subsidiaries.

i

ii Source: TD Asset Management Inc. Period from October 19, 2014 to October 18, 2024.

Latest Posts

Hot Companies

You might also like

Harvest ETFs Launches Two Funds Designed to Thrive in Volatile Times

Investors looking to learn more about the Harvest Premium Yield Canadian Bank ETF or the Harvest Premium Yield Enhanced ETF can go to Harvest ETFs | Equity Income ETFs | Harvest Portfolios Group where you’ll find product information, insight blogs, and videos.

Gigantic Bolivian Opportunity Coming into Focus for Eloro

A real opportunity is finally coming into focus for Eloro Resources. After a slow start out of the gates, their highly prospective flagship project in southern Bolivia is starting to generate some real buzz.